Gold reaches historic high

RT.com

14 Mar 2025, 14:35 GMT+10

The rally to more than $3,000 an ounce is driven by growing demand for safe-haven assets amid escalating trade tensions

Gold prices reached a record high on Thursday as investors spooked by mounting concerns over a global trade war seek safe-haven assets. The latest rally comes amid on-off tariff announcements by the US.

Import taxes on steel and aluminum imposed by US President Donald Trump took effect on Wednesday, sparking concerns in export-dependent Asia and prompting immediate retaliatory measures from the EU and Canada. Prior to the tariff imposition, Trump threatened to hike the levy on Canadian metals to 50%, but reversed the plan after Ontario Premier Doug Ford overturned his decision to introduce a 25% surcharge on electricity exports to several US states.

Gold futures for April delivery briefly hit $3,003.90 per ounce Thursday night on the Chicago Mercantile Exchange (CME) before retreating to $2,989.50, marking the first time a contract has crossed the psychologically important $3,000 threshold. Prices for the precious metal are up nearly 14% so far this year after making a solid 27% gain in 2024.

"The risk-off market stance reflects investors' expectations that trade tensions are likely to get worse before it cools, and are turning to safe-haven gold once again as a hedge against portfolio volatility," IG market strategist Yeap Jun Rong said, as cited by Reuters.

Apart from concerns related to global trade tensions, analysts attribute the latest rally in gold prices, an asset preferred by investors amid geopolitical and economic turmoil, to bets on monetary policy easing by the US Federal Reserve. The regulator is expected to keep its key interest rate in the 4.25%-4.50% range at the meeting scheduled for next Wednesday.

"The potential impact of the tariff and trade threats are impossible to model, forcing the Fed to gauge economic data to help it determine its next move," John Ciampaglia, CEO of Sprott Asset Management, told the news agency, adding that analysts "believe the Fed is stuck in a wait-and-see state."

Gold prices reached 40 record highs in 2024, driven by increasing geopolitical tensions in the Middle East and Eastern Europe, uncertainty regarding the outcome of the US presidential elections, interest rate cuts, and active gold purchases by major central banks, according to a survey by the World Gold Council.

In the latest analysis of volatility across commodity markets, the head of commodity strategy at TD Securities, Bart Melek, stated that central banks have seen record buying of gold in recent years due to concerns about the sustainability of dollar purchasing power and geopolitical tensions between major economic powers.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Chicago Chronicle news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Chicago Chronicle.

More InformationBusiness

SectionTravel to and from Israel to be boosted by terminal reopening

The principal terminal, Terminal 1, at Israel's largest airport will reopen at the end of this month, having largely been closed since...

Tech stocks lead renewed selling on Wall Street

NEW YORK, New York - The knee-jerk introduction of trade tariffs by President Donald Trump continues to rattle markets with all the...

Ford to invest up to $4.8 billion to revive struggling German unit

FRANKFURT, Germany: Ford announced this week that it will inject up to $4.8 billion into its struggling German unit to stabilize its...

Boeing links worker bonuses to company-wide performance

SEATTLE, Washington: Boeing has revamped its employee incentive plan, tying annual bonuses for more than 100,000 workers to overall...

US, Canadian farmers face rising fertilizer costs amid trade tensions

WINNIPEG, Manitoba: Farmers in the U.S. and Canada are bracing for soaring fertilizer prices as trade tensions escalate between the...

U.S. stocks stabilize after relentless losses

NEW YORK, New York - A slightly lower-than-expected CPI reading for February helped U.S. stocks to stabilize after some relentless...

Illinois

SectionSouth Dakota law blocks eminent domain for carbon pipelines

SIOUX FALLS, South Dakota: A new South Dakota law banning the use of eminent domain for carbon capture pipelines has cast doubt on...

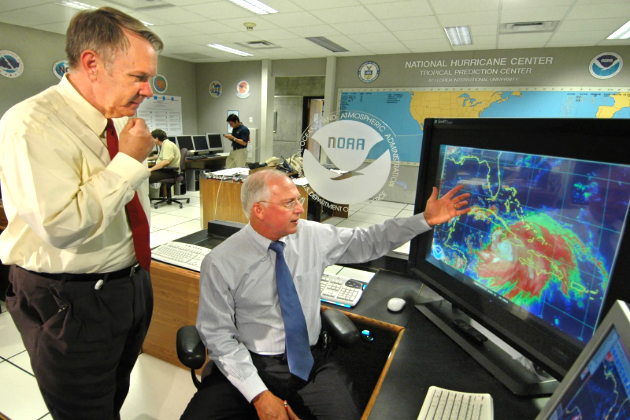

US weather agency faces big layoffs under Trump’s civil service cuts

WASHINGTON, D.C.: The U.S. weather agency, NOAA, plans to lay off 1,029 workers following 1,300 job cuts earlier this year. This...

US: Refilling oil reserve fully will cost $20 billion, take years

WASHINGTON, D.C.: The U.S. Energy Department estimates it will take US$20 billion and several years to refill the Strategic Petroleum...

Gold reaches historic high

The rally to more than $3,000 an ounce is driven by growing demand for safe-haven assets amid escalating trade tensions ...

NBA roundup: Stephen Curry sinks 4,000th 3-pointer

(Photo credit: D. Ross Cameron-Imagn Images) Stephen Curry became the first player in NBA history to make 4,000 career 3-pointers...

Big Ten tournament roundup: No. 20 Purdue edges USC

(Photo credit: Trevor Ruszkowski-Imagn Images) Trey Kaufman-Renn matched his career high of 30 points and sixth-seeded Purdue avoided...