SHAREHOLDER ALERT: Lowey Dannenberg, P.C. Files Securities Class Action Lawsuit on Behalf of Investors Who Acquired U.S. Bancorp Securities from August 1, 2019 to July 28, 2022, Inclusive, and Encourages Investors to Inquire About the Lead Plaintiff Posit

ACCESS Newswire

22 Nov 2022, 04:25 GMT+10

NEW YORK, NY, / ACCESSWIRE / November 21, 2022 / Lowey Dannenberg P.C., a preeminent law firm in obtaining redress for consumers and investors, has filed a federal securities class action in the United States District Court Southern District of New York on behalf of its client and all similarly situated investors who purchased or otherwise acquired securities of U.S. Bancorp. ('U.S. Bancorp' or the 'Company') (NYSE:USB) from August 1, 2019 to July 28, 2022, inclusive (the 'Class Period'). The class action alleges violations of the federal securities laws.

U.S. Bancorp is a Delaware company headquartered in Minneapolis, Minnesota. U.S. Bancorp provides a range of financial services, including lending and depository services, cash management, capital markets, and trust and investment management services. U.S. Bancorp's banking subsidiary, U.S. Bank National Association ('U.S. Bank'), is engaged in the general banking business. U.S. Bancorp is the publicly traded parent company of U.S. Bank.

U.S. Bancorp's stock was trading at $48.12 on July 28, 2022, but after the Consumer Financial Protection Bureau ('CFPB') issued a Consent Order and fined U.S. Bank $37.5 million for illegally exploiting consumers' personal data to open sham accounts, the price of U.S. Bancorp stock declined 4% to close at $46.12, on July 28, 2022.

The Complaint alleges that U.S. Bancorp made false and misleading statements to the public throughout the Class Period regarding the Company's business, operational, and compliance policies. Specifically, Defendants made false and misleading statements and/or failed to disclose that: (a) U.S. Bank created sales pressure on its employees that led them to open credit cards, lines of credit, and deposit accounts without consumers' knowledge and consent; (b) since at least 2015, U.S. Bank and by extension, U.S. Bancorp, was aware of such unauthorized conduct that it was violating relevant regulations and laws aimed at protecting its consumers; (c) U.S. Bancorp failed to properly monitor its employees from engaging in such unlawful conduct, detect and stop the misconduct, and identify and remediate harmed consumers; (d) all the foregoing subjected the Company to a foreseeable risk of heightened regulatory scrutiny or investigation; (e) U.S. Bancorp's revenues were in part the product of unlawful conduct and thus unsustainable; and (f) as a result, the Company's public statements were materially false and misleading at all relevant times.

If you wish to serve as Lead Plaintiff for the Class, you must file a motion with the Court no later than December 27, 2022. Any member of the proposed Class may move to serve as the Lead Plaintiff through counsel of their choice.

If you have suffered a net loss from investment in U.S. Bancorp's securities from August 1, 2019 and July 28, 2022, you may obtain additional information about this lawsuit and your ability to become a Lead Plaintiff, by contacting Alesandra Greco at [email protected] or Andrea Farah at [email protected] or by calling 914-733-7256. The class action is titled The Buhrke Family Revocable Trust v. U.S. Bancorp et al., No. 1:2022-cv-09174 (S.D.N.Y.).

Contact

Lowey Dannenberg P.C.

44 South Broadway, Suite 1100

White Plains, NY 10601

Tel: (914) 733-7256

Email: [email protected]

[email protected]

SOURCE: Lowey Dannenberg

View source version on accesswire.com:

https://www.accesswire.com/727654/SHAREHOLDER-ALERT-Lowey-Dannenberg-PC-Files-Securities-Class-Action-Lawsuit-on-Behalf-of-Investors-Who-Acquired-US-Bancorp-Securities-from-August-1-2019-to-July-28-2022-Inclusive-and-Encourages-Investors-to-Inquire-About-the-Lead-Plaintiff

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Chicago Chronicle news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Chicago Chronicle.

More InformationBusiness

SectionWall Street extends rally, Standard and Poor's 500 hits new high

NEW YORK, New York - U.S. stock markets closed firmly in positive territory to start the week Monday, with the S&P 500 and Dow Jones...

Canadian tax on US tech giants dropped after Trump fury

WASHINGTON, D.C.: On Friday, President Donald Trump announced that he was halting trade discussions with Canada due to its decision...

Trump-backed crypto project gets $100 million boost from UAE fund

LONDON, U.K.: A little-known investment fund based in the United Arab Emirates has emerged as the most prominent public backer of U.S....

DIY weight-loss drug trend surges amid high prices, low access

SAN FRANCISCO, California: Across the U.S., a growing number of people are taking obesity treatment into their own hands — literally....

Apple allows outside payment links under EU pressure

SAN FRANCISCO, California: Under pressure from European regulators, Apple has revamped its App Store policies in the EU, introducing...

Euro, pound surge as U.S. rate cut odds grow after Powell hint

NEW YORK CITY, New York: The U.S. dollar tumbled this week, hitting its lowest levels since 2021 against the euro, British pound, and...

Illinois

SectionHindu spiritual leader receives New York City honour at interfaith event

By Reena Bhardwaj New York [US], June 29 (ANI): A prominent Hindu spiritual leader has been recognised by New York City officials...

China Sports Weekly (6.22-6.28)

BEIJING, June 28 (Xinhua) -- Here are the latest Chinese sports headlines from the past week: 1. China's Wang Xinyu finishes runner-up...

From crash site to decoding lab: India handling AI-171 probe entirely in the country

By Naveen Kapoor New Delhi [India], June 27 (ANI): The Aircraft Accident Investigation Bureau (AAIB) Lab in New Delhi, is currently...

'The Social Network' sequel in works after 15 years' wait; Aaron Sorkin to direct

Washington DC [US], June 27 (ANI): 'The Social Network' fans are in for a treat as their favourite movie is coming back with a sequel....

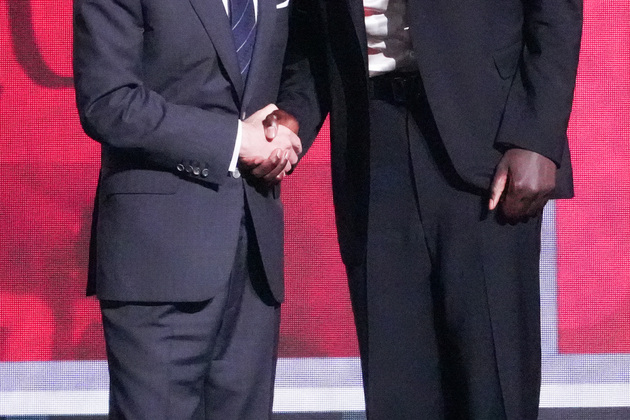

(SP)U.S.-NEW YORK-BASKETBALL-NBA DRAFT

(250626) -- NEW YORK, June 26, 2025 (Xinhua) -- Khaman Maluach (R) poses for a photo with NBA commissioner Adam Silver after being...

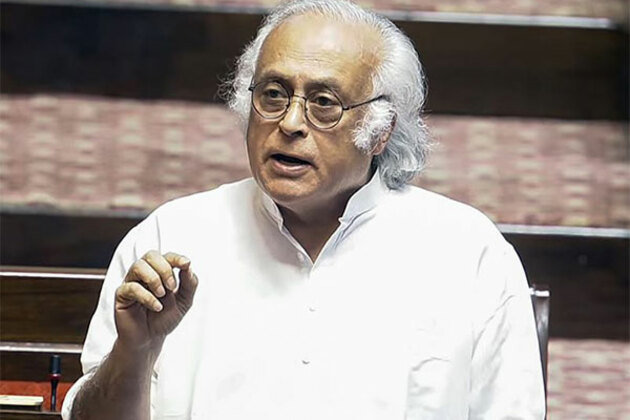

Jairam Ramesh slams delay in probe into Ahmedabad air crash, calls it 'inexplicable and inexcusable'

New Delhi [India], June 26 (ANI): Congress leader Jairam Ramesh on Thursday strongly criticised the delay in starting an official investigation...