Kingfisher Announces Upsize to Private Placement Financing

ACCESS Newswire

26 May 2022, 15:07 GMT+10

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR DISSEMINATION IN THE UNITED STATES

VANCOUVER, BC / ACCESSWIRE / May 26, 2022 / Kingfisher Metals Corp. (TSXV:KFR)(FSE:970)(OTCQB:KGFMF) ('Kingfisher' or the 'Company') is pleased to announce that, further to its news release dated April 27, 2022, and due to investor demand, it has upsized its non-brokered private placement (the 'Offering') from gross proceeds of up to C$3.0 million to up to C$4.9 million through the issuance of charity flow-through units at a price of C$0.28 per charity unit and flow-through units at a price of C$0.24 per FT unit of the company (collectively, the 'Offered Units').

The aggregate gross proceeds raised from the Offering will be used before 2024 for general exploration expenditures which will constitute Canadian exploration expenses (within the meaning of subsection 66(15) of the Income Tax Act (Canada) (the 'Tax Act')), that will qualify as 'flow through mining expenditures' within the meaning of the Tax Act.

All terms of the Offering remain the same, provided that the Company intends to issue up to a total of 17,891,671 Offered Units. Each Offered Unit will be comprised of one common share of the Company (each, a 'Common Share') and one-half of one common share purchase warrant (each whole warrant, a 'Warrant'), with each Warrant being exercisable for one Common Share at an exercise price of C$0.35 per Common Share at any time up to 24 months following the closing date of the Offering.

In connection with the Offering, the Company may pay finder's fees to certain finders, which fees would be a cash payment equal to up to 7% of the gross proceeds raised by purchasers introduced by such finders, and the issuance of non-transferable compensation warrants equal to up to 7% of the number of Offered Units purchased by purchasers introduced by such finders (each, a 'Compensation Warrant'). Each such Compensation Warrant will be exercisable for one Common Share at an exercise price of C$0.35 per Common Share at any time prior up to 24 months following the closing date of the Offering.

The Offering is expected to close on or about June 7, 2022, and is subject to approval of the TSX Venture Exchange. All securities issued pursuant to the Offering and as payment of any finder's fees, including Common Shares issuable upon the exercise of Warrants or Compensation Warrants, if any, will be subject to a hold period of four months and one day after the date of closing of the Offering.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the 'U.S. Securities Act') or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

About Kingfisher Metals Corp.

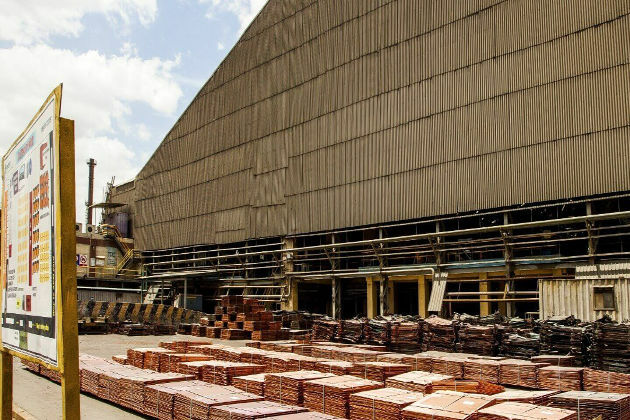

Kingfisher Metals Corp. (https://kingfishermetals.com/) is a Canadian based exploration company focused on underexplored district-scale projects in British Columbia. Kingfisher has three 100% owned district-scale projects that offer potential exposure to high-grade gold, copper, silver, and zinc. The Company currently has 85,173,300 shares outstanding.

For further information, please contact:

Dustin Perry, P.Geo.

CEO and Director

Phone: +1 236 358 0054

E-Mail: [email protected]

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains statements that constitute 'forward-looking statements.' Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company's actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words 'expects,' 'plans,' 'anticipates,' 'believes,' 'intends,' 'estimates,' 'projects,' 'potential' and similar expressions, or that events or conditions 'will,' 'would,' 'may,' 'could' or 'should' occur.

Forward-looking statements in this news release include, among others, statements relating to expectations regarding the expected closing date of the Offering, and other statements that are not historical facts. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors and risks include, among others: the Company may require additional financing from time to time in order to continue its operations which may not be available when needed or on acceptable terms and conditions acceptable; compliance with extensive government regulation; domestic and foreign laws and regulations could adversely affect the Company's business and results of operations; the stock markets have experienced volatility that often has been unrelated to the performance of companies and these fluctuations may adversely affect the price of the Company's securities, regardless of its operating performance; and the impact of COVID-19.

The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

SOURCE: Kingfisher Metals Corp.

View source version on accesswire.com:

https://www.accesswire.com/702768/Kingfisher-Announces-Upsize-to-Private-Placement-Financing

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Chicago Chronicle news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Chicago Chronicle.

More InformationBusiness

SectionFilmmaker joins biotech effort to bring back extinct giant bird

WASHINGTON, D.C.: Filmmaker Peter Jackson's lifelong fascination with the extinct giant New Zealand flightless bird called the moa...

India seeks WTO nod for retaliatory tariffs on US

NEW DELHI, India: India has submitted a revised proposal to the World Trade Organization (WTO) in Geneva to implement retaliatory tariffs...

AI boom propels Nvidia to historic market cap milestone

SAN FRANCISCO, California: Nvidia, the Silicon Valley chipmaker at the heart of the artificial intelligence boom, this week briefly...

AI saves $500 million for Microsoft as layoffs reshape strategy

REDMOND, Washington: Artificial intelligence is transforming Microsoft's bottom line. The company saved over US$500 million last year...

FTC’s rule to ease subscription cancellations struck down by court

WASHINGTON, D.C.: A federal rule designed to make it easier for Americans to cancel subscriptions has been blocked by a U.S. appeals...

Musk’s X loses CEO Linda Yaccarino amid AI backlash, ad woes

BASTROP, Texas: In a surprising turn at Elon Musk's X platform, CEO Linda Yaccarino announced she is stepping down, just months after...

Illinois

SectionRubio impersonator used AI to reach officials via Signal: cable

WASHINGTON, D.C.: An elaborate impersonation scheme involving artificial intelligence targeted senior U.S. and foreign officials in...

Reds look to beat Rockies, get Terry Francona 2,000th win

(Photo credit: David Richard-Imagn Images) In a span of 10 pitches Saturday, the Cincinnati Reds ensured they wouldn't be swept for...

MLB roundup: Garrett Crochet tosses first shutout in Red Sox win

(Photo credit: Eric Canha-Imagn Images) In his 51st career start, Garrett Crochet accomplished two feats in one dominant outing:...

Anders Dreyer brace helps San Diego FC hold off Chicago Fire

(Photo credit: Matt Marton-Imagn Images) Anders Dreyer recorded a first-half brace, and Western Conference-leading San Diego FC withstood...

Connor Zilisch holds off Shane van Gisbergen for thrilling Sonoma win

(Photo credit: Stan Szeto-Imagn Images) SONOMA, Calif. - In closing laps of the Pit Boss/FoodMaxx 250 at Sonoma Raceway, the pupil...

Kyle Manzardo homer lifts Guardians past White Sox

(Photo credit: Patrick Gorski-Imagn Images) Kyle Manzardo hit a go-ahead solo home run in the sixth inning and Tanner Bibee earned...