Bank of China Released Report on Global Asset Allocation Strategy: A-shares and H-shares are Recommended

ACCESS Newswire

13 Jan 2022, 19:49 GMT+10

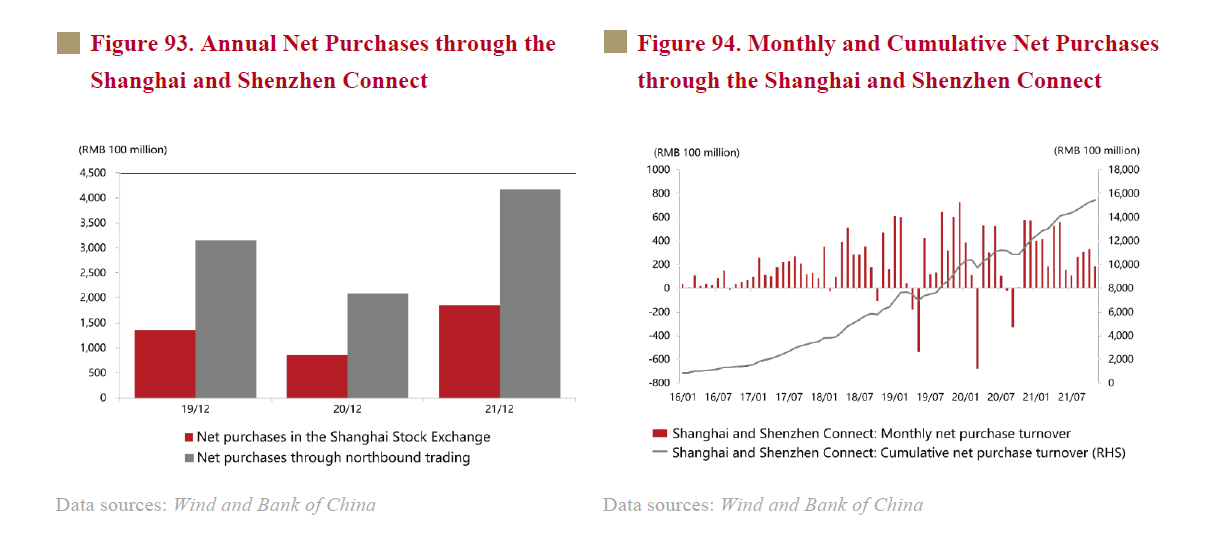

NEW YORK, NY / ACCESSWIRE / January 13, 2022 / Bank of China (SEHK:3988) released the Report on Global Asset Allocation Strategy by Private Banking of China for the fourth consecutive year, suggesting that in 2022, the global asset should be allocated following the order of equity, bonds, gold, commodities. The report states that China's assets will be revalued as the country's economic recovery slows down and seeks stability.

According to the report, China's stock market is still in the early stage of recovery and is expected to rise in 2022 at a rate comparable to that of 2021, but with a more balanced structure and better investment experience. In terms of industry segments, technological advancement, sci-tech innovation, and high-end manufacturing will be the theme of the year, while mass consumption will be worth looking forward to.

In the Bank of China's view, the manufacturing investment will be the key driver to China's economic recovery in the future. Looking ahead to 2022, although China's economy is pressured by contracting demand, supply shock, and weakening expectations, supported by the easy monetary policy which prioritizes the structure and the proactive fiscal policy, the recovery will be slow but steady. The manufacturing industry, as a variable, will transform from facilitating to driving economic growth.

Bank of China remains positive on the future outlook for Chinese stock allocation and continues to recommend Chinese stocks in global equity markets. It believes that A-shares are expected to boom after a turnaround in 2019, a recovery in 2020, and a renewed trend in 2021. A-shares are expected to remain in the early stage of recovery in 2022 and bullish qualitatively throughout the year, with a more balanced structure and better investment experience.

'The Chinese stock market is expected to continue recovering in 2022 and presents greater opportunities than in 2021, with the trend further strengthened and recognized.' The report believes that contracting credit policy will shift towards being proactive in 2022, assisting in valuation increases; price scissors between PPI and CPI will gradually narrow, and midstream and downstream enterprises will see rising profits. Meanwhile, as the pandemic becomes history, a recovery in mass consumption is expected. Moreover, domestic residents' assets rebalancing is accelerating, so is Chinese asset allocation from the overseas funds. Incremental funds are still considerable, but we need to pay attention to whether changes in global and domestic inflation expectations will lead to wide fluctuations in the stock market.

Bank of China forecasts that the overall financial needs of the A-share market will reach RMB ¥2.5-2.6 trillion in 2022, with equity financing needs of RMB ¥1.5-1.6 trillion as economic activity increases in the post-pandemic era and corporates are more willing to invest.

In addition to A-shares, Hong Kong stocks, whose valuation was at a historical low last year, have become the key investment recommended by the Bank of China this year with its cost-effectiveness further noted. The year 2022 might be the turning point where Hong Kong stocks return to the value with a bigger probability of rising valuation.

'The current absolute valuation of the HSI is lower than that of A-shares, the three major US stock indexes, major Japanese or European stock indexes, while its dividend yield is higher than that of the aforementioned major markets and the yield of the US 10-year Treasury bond. Taken together, the HSI has significant valuation advantages over the major global stock indexes and major risk-free asset yields, said Bank of China, also from the AH premium, the values of Hong Kong stocks are at a low compared to A-shares, which indicates high investment value in the medium to long term.

In addition, the report also points out that the U.S. economy is still resilient with strong demand for equity allocations and recommends U.S. stocks as standard allocation. But caution is needed for the sharp fluctuations that may occur when the Federal Reserve increases interest rates. European stocks are recommended as well as its recovery is gaining momentum with moderate policies. The same goes for Japanese stocks as there is great liquidity support and they are fundamentally sound. Among emerging markets, Southeast Asia is the highlight, including Vietnam and the Philippines. Caution is needed for Indian enterprises with a high valuation.

Media Contact:

Pinzhang Li

E-mail: [email protected]

Website: https://www.boc.cn/en/

SOURCE: Bank of China

View source version on accesswire.com:

https://www.accesswire.com/683350/Bank-of-China-Released-Report-on-Global-Asset-Allocation-Strategy-A-shares-and-H-shares-are-Recommended

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Chicago Chronicle news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Chicago Chronicle.

More InformationBusiness

SectionWall Street diverges, but techs advance Wednesday

NEW YORK, New York - U.S. stocks diverged on Wednesday for the second day in a row. The Standard and Poor's 500 hit a new all-time...

Greenback slides amid tax bill fears, trade deal uncertainty

NEW YORK CITY, New York: The U.S. dollar continues to lose ground, weighed down by growing concerns over Washington's fiscal outlook...

Taliban seeks tourism revival despite safety, rights concerns

KABUL, Afghanistan: Afghanistan, long associated with war and instability, is quietly trying to rebrand itself as a destination for...

Nvidia execs sell $1 billion in stock as AI boom drives record prices

SANTA CLARA, California: Executives at Nvidia have quietly been cashing in on the AI frenzy. According to a report by the Financial...

Tech stocks slide, industrials surge on Wall Street

NEW YORK, New York - Global stock indices closed with divergent performances on Tuesday, as investors weighed corporate earnings, central...

Canada-US trade talks resume after Carney rescinds tech tax

TORONTO, Canada: Canadian Prime Minister Mark Carney announced late on June 29 that trade negotiations with the U.S. have recommenced...

Illinois

SectionChina boosting purchases of Russian metals Bloomberg

Aluminum, copper and nickel shipments have surged this year, according to trade data Beijing has increased purchases of Russian metals...

Hindu spiritual leader receives New York City honour at interfaith event

By Reena Bhardwaj New York [US], June 29 (ANI): A prominent Hindu spiritual leader has been recognised by New York City officials...

China Sports Weekly (6.22-6.28)

BEIJING, June 28 (Xinhua) -- Here are the latest Chinese sports headlines from the past week: 1. China's Wang Xinyu finishes runner-up...

From crash site to decoding lab: India handling AI-171 probe entirely in the country

By Naveen Kapoor New Delhi [India], June 27 (ANI): The Aircraft Accident Investigation Bureau (AAIB) Lab in New Delhi, is currently...

'The Social Network' sequel in works after 15 years' wait; Aaron Sorkin to direct

Washington DC [US], June 27 (ANI): 'The Social Network' fans are in for a treat as their favourite movie is coming back with a sequel....

Can Musks proposed America Party become a Republican party pooper

Elon Musk has threatened to launch a new party to undermine US President Donald Trump, following a falling out over a spending bill....