Bybit Launches USDT Perpetual Contracts, Taking Trading Portfolio Management to the Next Level

ACCESS Newswire

24 Mar 2020, 22:01 GMT+10

SINGAPORE / ACCESSWIRE / March 24, 2020 / Bybit is pleased to announce it is adding Tether (USDT) perpetual contracts to its range of crypto-backed derivative products. USDT contracts will use USDT as both the quote and settlement currency. It will enable two-way trades allowing traders to hold both long and short positions concurrently and with different leverages. All profits, losses, and account balances will be denominated in USDT, making it easier for traders to make investment decisions using a stable currency.

USDT perpetual contracts aim to replicate the underlying spot markets but with increased leverage. Similar to Bybit's existing perpetual contracts, USDT contracts will have no expiry date. The price will be tethered to the underlying index, ensuring full price accuracy.

USDT contracts will bring multiple new features and create additional flexibility for traders in managing their portfolios.

The ability to hold both long and short positions concurrently means that traders are better able to hedge their positions. For example, a trader could open a long-term long position with low leverage and a short-term short position with high leverage. In a cross-margin mode, this will mean traders can avoid having their positions enter auto-liquidation in the event of market volatility. They can also add an extra margin to a position, or opt for Auto Margin Replenishment, where funds will be taken from their account and added to their margin balance automatically.

Previously, Bybit denominated profits and losses in the currency underlying the contract, meaning that traders had account balances in multiple currencies. If they received a margin call, it would mean topping up their margin using the relevant asset underlying the contract.

In contrast, USDT contracts provide full flexibility across different contract types. Cross-margin enables unrealized profit and loss sitting on the account to be deployed as a top-up margin for other positions and even across other contracts. In practice, this means that floating profits can be used to execute trades in different contracts.

For example, if a trader has a floating profit on a BTC-USDT contract, they could use those unrealized gains to execute a second trade in an ETH-USDT contract. The inverse is also true, so traders can use their floating profits to prevent positions with any supported underlying asset from liquidation.

Along with these significant enhancements, Bybit will be rolling out several other new features. The Take-Profit/Stop-Loss (TP/SL) setting can now be found within the order placement window. This would enable traders to directly set TP/SL limits when they place an order.

To speed up the ordering process, traders can now quickly open and close positions and inverse positions at the K-line area. This reduces the chance of missing out on a swift trade during periods of market volatility. Traders can also flip their positions directly on the chart.

Bybit is also introducing changes to its margin requirements, making them substantially lower than competitor exchanges with a more sizable step up for each level.

Finally, traders launching multiple contracts will have the opportunity to participate in a shared insurance fund, helping to offset the risk of liquidation even further.

The introduction of USDT contracts, along with all the features listed above, will be visible for Bybit users with immediate effect.

About Bybit

Bybit is a global cryptocurrency derivatives exchange established in March 2018 and registered in the BVI. It is headquartered in Singapore and has offices in Hong Kong and Taiwan. Bybit has a global user base comprising everyone from individual retail clients to professional derivatives traders.

Bybit's technology team includes experts from numerous leading companies such as Morgan Stanley, Tencent, Ping' an Bank, and Nuoya Fortune. The exchange offers traders a matching engine capable of 100,000 transactions per second with no downtime. Bybit is committed to creating a fair, transparent, and efficient trading environment for all.

For more information please visit: www.bybit.com

Contact:

Dan Edelstein

[email protected]

+972-545-464-238

SOURCE: Bybit

View source version on accesswire.com:

https://www.accesswire.com/582062/Bybit-Launches-USDT-Perpetual-Contracts-Taking-Trading-Portfolio-Management-to-the-Next-Level

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Chicago Chronicle news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Chicago Chronicle.

More InformationBusiness

SectionWall Street extends rally, Standard and Poor's 500 hits new high

NEW YORK, New York - U.S. stock markets closed firmly in positive territory to start the week Monday, with the S&P 500 and Dow Jones...

Canadian tax on US tech giants dropped after Trump fury

WASHINGTON, D.C.: On Friday, President Donald Trump announced that he was halting trade discussions with Canada due to its decision...

Trump-backed crypto project gets $100 million boost from UAE fund

LONDON, U.K.: A little-known investment fund based in the United Arab Emirates has emerged as the most prominent public backer of U.S....

DIY weight-loss drug trend surges amid high prices, low access

SAN FRANCISCO, California: Across the U.S., a growing number of people are taking obesity treatment into their own hands — literally....

Apple allows outside payment links under EU pressure

SAN FRANCISCO, California: Under pressure from European regulators, Apple has revamped its App Store policies in the EU, introducing...

Euro, pound surge as U.S. rate cut odds grow after Powell hint

NEW YORK CITY, New York: The U.S. dollar tumbled this week, hitting its lowest levels since 2021 against the euro, British pound, and...

Illinois

SectionHindu spiritual leader receives New York City honour at interfaith event

By Reena Bhardwaj New York [US], June 29 (ANI): A prominent Hindu spiritual leader has been recognised by New York City officials...

China Sports Weekly (6.22-6.28)

BEIJING, June 28 (Xinhua) -- Here are the latest Chinese sports headlines from the past week: 1. China's Wang Xinyu finishes runner-up...

From crash site to decoding lab: India handling AI-171 probe entirely in the country

By Naveen Kapoor New Delhi [India], June 27 (ANI): The Aircraft Accident Investigation Bureau (AAIB) Lab in New Delhi, is currently...

'The Social Network' sequel in works after 15 years' wait; Aaron Sorkin to direct

Washington DC [US], June 27 (ANI): 'The Social Network' fans are in for a treat as their favourite movie is coming back with a sequel....

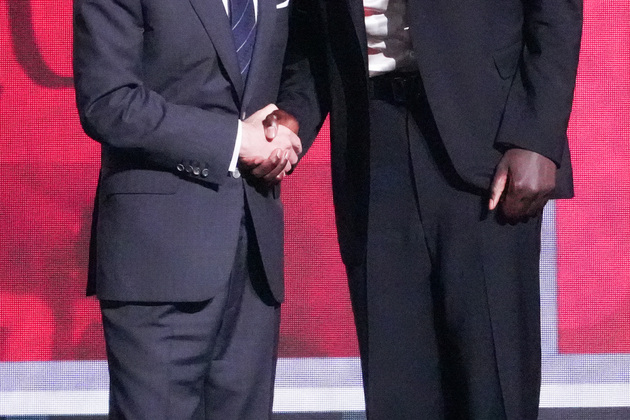

(SP)U.S.-NEW YORK-BASKETBALL-NBA DRAFT

(250626) -- NEW YORK, June 26, 2025 (Xinhua) -- Khaman Maluach (R) poses for a photo with NBA commissioner Adam Silver after being...

Jairam Ramesh slams delay in probe into Ahmedabad air crash, calls it 'inexplicable and inexcusable'

New Delhi [India], June 26 (ANI): Congress leader Jairam Ramesh on Thursday strongly criticised the delay in starting an official investigation...