Insurance Agency Mergers and Acquisitions First Nine Months of 2019 Break Record, OPTIS Partners Reports

ACCESS Newswire

08 Oct 2019, 18:35 GMT+10

Data Covering Property & Casualty and Employee Benefits Brokers Shows that Big Players Continue to Pay Top Dollar for Acquisitions in the US and Canada

CHICAGO, IL / ACCESSWIRE / October 8, 2019 / There were 490 announced insurance agency mergers and acquisitions during the first three quarters of the year, according to OPTIS Partners' M&A database. It was the highest nine-month total ever, beating the 481 deals announced in 2018.

The data covers U.S. and Canadian agencies selling primarily property-and-casualty insurance, agencies selling both P&C and employee benefits, and those selling only employee benefits.

There were 158 transactions in the third quarter alone, making it the second most-active third quarter ever.

'Agency valuations continue pushing new upper limits, and there are no signs of any slowdown in M&A activity,' said Daniel P. Menzer of OPTIS Partners, an investment banking and financial consulting firm specializing in the insurance industry.

Deals by Buyer Type

The OPTIS Partners report breaks down buyers into four groups: private equity-backed/hybrid brokers, privately held brokers, publicly held brokers, and all others.

PE/hybrid buyers continue to lead all buyer groups with 66 percent of the total transactions through the first nine months (320 in total). Acquisitions by privately owned agencies were the next most active group, accounting for 20 percent of deals.

For the nine-month period, Acrisure led all buyers with 71 transactions, followed by Hub International Limited (37), Gallagher (27), Broadstreet Partners (27), and AssuredPartners (26).

Deals by Seller Type

The reports break down sellers into four groups: property & casualty brokers, P&C/benefits brokers, employee benefits agencies, and all others.

Sales of P&C agencies continue to dominate the seller landscape with 252 announced transactions, followed by employee benefits agencies (123 sales), P&C/benefits brokers (63 deals), and all others (52 transactions).

'Recent economic data is somewhat mixed but generally less optimistic than in recent periods. We'll have to wait and see what, if any, impact this has on buyer appetites and valuation practices,' said Timothy J. Cunningham, managing partner with OPTIS Partners.

A few of the larger buyers have been acquiring stand-alone wealth management/investment advisory firms. Thus far, OPTIS has not included these transactions in its report.

Canadian Activity

37 out of the 490 reported deals took place in Canada, representing approximately 7.6 percent of the total, the highest percentage of Canadian-based sellers, and second only to California (65) in the number of transactions in 2019.

Not all transactions are announced, so the actual number of agency sales undoubtedly exceeded the number reported, according to Menzer.

'But our data collection process is consistent from period to period and includes a variety of sources. We're confident the deal activity measured over time reflects of the overall M&A marketplace,' he said.

The full report can be read at http://optisins.com/wp/2019/10/september-2019-ma-report.

OPTIS Partners was ranked in the top five most active agent-broker M&A advisory firms for 2014 - June 2019 by S&P Global Market Intelligence.

Focused exclusively on the insurance-distribution marketplace, Chicago-based OPTIS Partners (www.optisins.com) offers merger & acquisition representation for buyers and sellers, including due-diligence reviews. It provides appraisals of fair market value; financial performance review, including trend analysis and internal controls; and ownership transition and perpetuation planning.

Contact: Tim Cunningham, OPTIS Partners, [email protected], 312-235-0081

Dan Menzer, OPTIS Partners, [email protected], 630-520-0490

Henry Stimpson, Stimpson Communications, 508-647-0705 [email protected]

SOURCE: OPTIS Partners

View source version on accesswire.com:

https://www.accesswire.com/562349/Insurance-Agency-Mergers-and-Acquisitions-First-Nine-Months-of-2019-Break-Record-OPTIS-Partners-Reports

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Chicago Chronicle news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Chicago Chronicle.

More InformationBusiness

SectionAI saves $500 million for Microsoft as layoffs reshape strategy

REDMOND, Washington: Artificial intelligence is transforming Microsoft's bottom line. The company saved over US$500 million last year...

FTC’s rule to ease subscription cancellations struck down by court

WASHINGTON, D.C.: A federal rule designed to make it easier for Americans to cancel subscriptions has been blocked by a U.S. appeals...

Musk’s X loses CEO Linda Yaccarino amid AI backlash, ad woes

BASTROP, Texas: In a surprising turn at Elon Musk's X platform, CEO Linda Yaccarino announced she is stepping down, just months after...

Ex-UK PM Sunak takes advisory role at Goldman Sachs

NEW YORK CITY, New York: Former British prime minister Rishi Sunak will return to Goldman Sachs in an advisory role, the Wall Street...

Gold ETF inflows hit 5-year high as tariffs drive safe-haven bets

LONDON, U.K.: Physically backed gold exchange-traded funds recorded their most significant semi-annual inflow since the first half...

PwC: Copper shortages may disrupt 32 percent of chip output by 2035

AMSTERDAM, Netherlands: Some 32 percent of global semiconductor production could face climate change-related copper supply disruptions...

Illinois

SectionRubio impersonator used AI to reach officials via Signal: cable

WASHINGTON, D.C.: An elaborate impersonation scheme involving artificial intelligence targeted senior U.S. and foreign officials in...

Twins seek series victory vs. slumping Pirates

(Photo credit: Charles LeClaire-Imagn Images) The Minnesota Twins will try to make it three series victories in a row when they take...

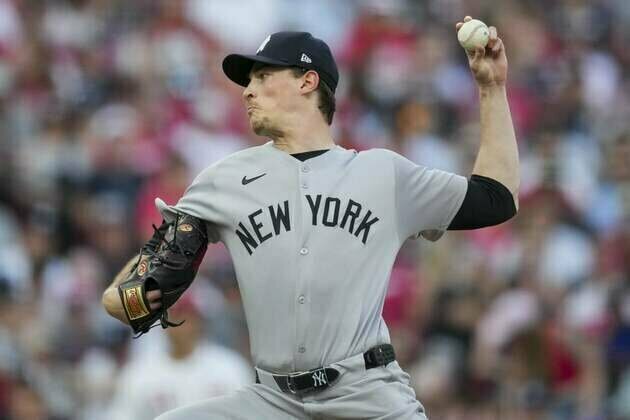

Yankees aim for season-best winning streak against Cubs

(Photo credit: Aaron Doster-Imagn Images) Cody Bellinger spent the past two years rejuvenating his career with the Chicago Cubs....

MLB roundup: Yanks bomb Cubs on Cody Bellinger's 3 HRs

(Photo credit: Wendell Cruz-Imagn Images) Cody Bellinger hit three homers for the first time in his career and drove in six runs,...

White Sox edge Guardians in 11th to split doubleheader

(Photo credit: Matt Marton-Imagn Images) Mike Tauchman delivered a game-ending infield single in the 11th inning and Lenyn Sosa homered...

Paul McCartney announces fall 'Got Back' North American Tour; check out dates

Washington, DC [US], July 12 (ANI): The Beatles legend Paul McCartney is hitting the road again. The singer-songwriter has announced...